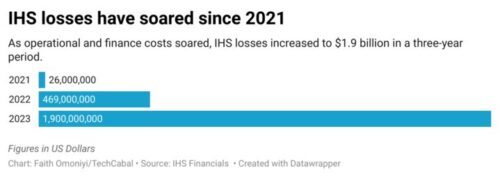

Once hailed as Africa’s most valuable technology company, IHS Towers has experienced a significant decline in market value since its 2021 NYSE debut. The company’s valuation has plummeted by $6 billion, primarily due to mounting operational and financial costs, exacerbated by Nigeria’s economic challenges.

The Nigerian market, a key revenue driver for IHS, has been grappling with soaring inflation and unstable currency exchange rates. These factors have significantly increased the company’s expenses, particularly in powering its extensive network of towers. Despite efforts to transition to renewable energy sources, the reliance on diesel generators remains a major cost burden.

Investors have reacted negatively to these challenges, leading to a decline in share price and a loss of confidence. While the company has secured crucial contract renewals with major telecom operators like MTN and Airtel, shareholders are seeking more tangible evidence of revenue growth and cost reduction.

As IHS Towers navigates these turbulent times, its ability to adapt to changing market conditions and deliver sustainable growth will be crucial in restoring investor trust and regaining its former glory.