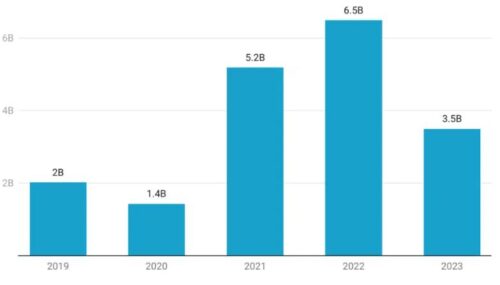

The exuberant growth of African startup funding witnessed between 2019 and 2021 has given way to a more sobering reality. Fueled by a global wave of easy money, the sector experienced a surge in investment, attracting a wave of venture capital into the continent. However, the tide has turned, with 2023 witnessing a significant decline in funding activity, mirroring pre-2016 levels.

This shift has created a challenging environment for both startups and investors. Startups now face heightened scrutiny and must demonstrate strong fundamentals and a clear path to profitability to secure funding. Simultaneously, investors are facing increased pressure from limited partners (LPs) to deliver tangible returns, leading to a more cautious and selective investment approach.

The days of easy fundraising are over. Investors are now demanding proof of concept and concrete evidence of revenue generation. This increased scrutiny, while challenging for startups, ultimately benefits the ecosystem by fostering a more sustainable and robust environment.

The focus on profitability is not without its complexities. While VCs encourage startups to prioritize profitability, it does not automatically guarantee investment. Founders must also demonstrate strong product-market fit and a compelling vision for long-term growth.

Furthermore, the scarcity of successful exits remains a significant concern. While the Paystack acquisition served as a landmark event, the lack of publicized exits with substantial returns hinders the industry’s ability to attract and retain investor confidence.

Moving forward, both founders and investors must adapt to this new reality. Startups need to focus on building sustainable businesses with strong unit economics and a clear path to profitability. Investors, on the other hand, must demonstrate a track record of successful exits and build stronger relationships with LPs to secure continued funding.

This period of adjustment presents both challenges and opportunities. By embracing a more disciplined and sustainable approach to investment, the African startup ecosystem can emerge stronger, fostering long-term growth and creating a more resilient and impactful entrepreneurial landscape.