Recent data from the National Bureau of Statistics (NBS) reveals that manufacturing, telecommunications, and the mining and quarrying sectors have become Nigeria’s top three sources of Value Added Tax (VAT) revenue.

Other significant contributors to the government’s VAT earnings include public administration, defense, financial services, and wholesale and retail trade.

According to a report by FBNQuest, VAT revenue witnessed an impressive year-on-year growth of 88%, reflecting a substantial rise compared to the previous year. This increase was fueled by a broad-based uptick in collections across various revenue streams.

Domestic VAT, which excludes import duties, played a crucial role in the quarterly growth, contributing around 52% of the total revenue. In Q3, domestic VAT collections amounted to NGN922.9 billion, up from NGN792.6 billion recorded in the preceding quarter.

Foreign (non-import) VAT and import VAT accounted for approximately 25% and 23% of total collections, respectively, both experiencing quarter-on-quarter growth of 13% and 10%, with revenues reaching NGN448.9 billion and NGN410 billion.

Sectoral Contributions to VAT Revenue

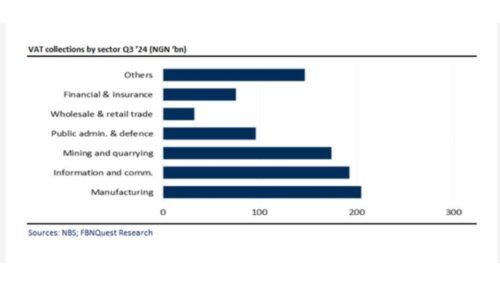

Among the major sectors, manufacturing maintained its position as the largest VAT contributor, generating nearly NGN205 billion in revenue.

The telecommunications and ICT sector followed closely, contributing approximately NGN192.8 billion during the quarter.

The mining and quarrying sector, alongside public administration and defense, added NGN174.4 billion and NGN95.9 billion, respectively, to the VAT pool.

Overall VAT Growth and Future Prospects

Total VAT revenue collected in the third quarter reached NGN1.8 trillion, bringing the cumulative figure for the first nine months of 2024 to NGN4.8 trillion—double the NGN2.4 trillion collected in the same period in 2023.

The surge in VAT revenue has been attributed to exchange rate fluctuations and improved tax administration processes.

Despite the increase in collections, Nigeria’s revenue-to-GDP ratio remains relatively low at 7% to 9%, significantly below the levels seen in other emerging economies.

To address this, the government is planning a series of tax reforms aimed at expanding the tax base, minimizing tax waivers, and improving VAT compliance. These measures are expected to enhance revenue generation and support the nation’s fiscal objectives.