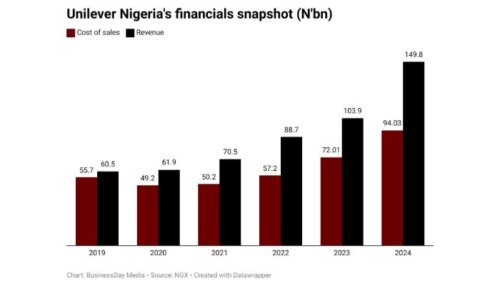

Unilever Nigeria, one of the country’s leading consumer goods manufacturers, is grappling with escalating production costs fueled by persistent inflation and soaring raw material prices. This trend has significantly impacted its cost of sales, which surged to ₦94.03 billion in 2024, up from ₦72.01 billion in 2023. The company’s fourth-quarter expenses also jumped sharply, reaching ₦33.01 billion compared to ₦23.9 billion in the same period the previous year.

According to analysts at CardinalStone Securities, the surge reflects a 30.6% year-on-year increase in production costs, driven primarily by inflationary pressures and higher prices of raw materials. Unilever’s competitors are facing similar hurdles, with Cadbury Nigeria’s cost of sales rising to ₦111.7 billion from ₦63.04 billion over the same period, underscoring the widespread impact of Nigeria’s economic environment on the FMCG sector.

Despite these cost challenges, Unilever Nigeria’s financial performance showed resilience. The company’s after-tax profit more than doubled, rising from ₦8.44 billion in 2023 to ₦15.9 billion in 2024. Revenue also experienced robust growth, increasing from ₦103.9 billion to ₦149.8 billion. This growth contributed to improved returns, with notable gains in both Return on Equity (ROE) and Return on Assets (ROA), reflecting greater operational efficiency and profitability.

Unilever’s share price saw a modest uptick, climbing from ₦36 at the start of the year to ₦38 as of January 30, 2024. The company maintains an outstanding share volume of 5.75 billion, reinforcing its strong market presence.

In terms of liquidity, Unilever reported an increase in cash and cash equivalents, which rose to ₦68.8 billion. This figure comprises ₦41.6 billion held in bank accounts and ₦27.2 billion in fixed deposits, reflecting strong cash management strategies amid challenging economic conditions.

However, the company’s brand and marketing expenses saw a significant rise, doubling from ₦7.4 billion to ₦14.7 billion. This increase was primarily driven by higher media expenditures to promote personal care and food products. Unilever explained that the boost in marketing spend was part of a strategic effort to enhance product visibility and support various promotional campaigns across its key brands.

Regarding intellectual property arrangements, Unilever Nigeria previously paid royalties to Unilever Plc UK for technology and trademark licenses. These payments amounted to 2% and 0.5% of net sales for technology and trademark rights, respectively. However, effective February 2023, the ownership of these exclusive IP rights shifted to Unilever Global IP Limited and Unilever IP Holdings B.V., with the total license fees for 2024 amounting to ₦4.1 billion.

The company also faced rising overhead costs, which climbed to ₦11.27 billion from ₦4.45 billion. This spike was largely attributed to the impact of the naira devaluation, which increased the cost of foreign-denominated obligations, as well as general inflation affecting goods and services. Additionally, investments in workforce capability development contributed to the higher overheads.

Another notable development was the growth in deposits for imports, which rose sharply from ₦1.5 billion in 2023 to ₦7.9 billion in 2024. Meanwhile, finance income grew to ₦7.16 billion, driven by interest earnings from call deposits (₦3.67 billion), exchange rate gains on bank balances (₦3.44 billion), and income from lease receivables (₦56.3 million).

In a strategic shift, Unilever Nigeria exited the Home Care business in 2023. The company announced this decision in March 2023, ceased production of home care products by June, and discontinued sales by September. This move was part of a broader strategy to focus on higher-margin product categories. Although the home care segment does not qualify as a disposal group under accounting rules—since the assets were leased rather than sold—it is classified as a discontinued operation due to its significance as a separate business line.

Unilever’s related-party transactions also saw growth, with the sale of finished goods to affiliates increasing from ₦2.7 billion to ₦3.89 billion. The majority of these sales were to Unilever Côte d’Ivoire Limited (₦3.8 billion), followed by Unilever Asia Private Limited (₦55.9 million) and Unilever Ghana Limited (₦24.7 million).

As Unilever navigates Nigeria’s challenging economic landscape, its ability to manage costs, maintain profitability, and adapt to market shifts will be critical to sustaining growth in the years ahead.