Meeting Rescheduled

The Central Bank of Nigeria (CBN) has officially rescheduled the first Monetary Policy Committee (MPC) meeting of 2025. Originally set for February 17 and 18, the meeting will now take place on February 18 and 19. This change comes after delays by the National Bureau of Statistics (NBS) in releasing the rebased Consumer Price Index (CPI), which is crucial for the meeting’s deliberations.

What to Expect from the Meeting

With the meeting date now confirmed, attention is focused on the likely outcome. Many analysts are eagerly awaiting the decision on whether the Monetary Policy Rate (MPR) will remain unchanged or experience an increase. Given the current trends, this will be a critical point of discussion.

Notably, the MPC’s first meeting of the year was delayed. It was originally scheduled for January, but was postponed, creating some uncertainty about the bank’s approach to inflation control.

Impact of Past MPC Decisions

Looking back, the last MPC meeting in November 2024 had a significant impact. During this meeting, the MPR was increased by 25 basis points, bringing it to 27.50%. This was done in response to rising inflation, which had reached 33.88% in October 2024. Additionally, the committee chose to keep other key policies, such as the Cash Reserve Ratio (CRR) and Liquidity Ratio, unchanged.

However, despite these actions, inflation has continued to rise. By December 2024, inflation hit 34.8%, marking the fourth consecutive increase. On the other hand, food inflation showed a slight improvement, dropping marginally to 39.84%.

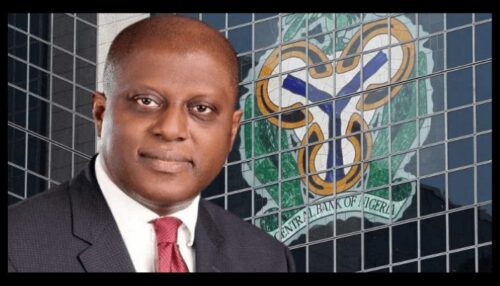

CBN’s Ongoing Commitment

Governor Yemi Cardoso has made it clear that the CBN remains fully committed to combating inflation. He stated that the bank would not relent and would continue using every available tool. Therefore, the focus is firmly on stabilizing the economy through conventional monetary policies.

Looking ahead, the upcoming MPC meeting is expected to be pivotal. The decisions made during this meeting could have a lasting impact on the country’s economic trajectory, potentially affecting inflation, interest rates, and the overall stability of the economy.