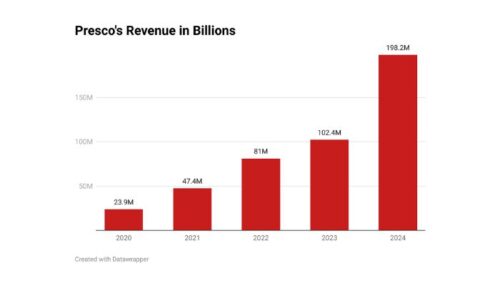

Presco has demonstrated an outstanding financial trajectory, achieving an impressive 93% revenue growth in 2024 alone. Over the past five years, the company has expanded nearly ninefold, progressing from N23.9 billion in 2020 to N198.2 billion by the end of 2024. This remarkable performance places Presco ahead of its closest competitor, Okomu Oil Palm, and serves as a model for business sustainability and profitability.

How Presco Surpassed Its Competition

Five years ago, Presco and Okomu Oil Palm were operating at similar revenue levels. In 2020, both companies reported earnings around N23 billion, with Presco posting a net profit of N5.3 billion, while Okomu Oil Palm recorded N2.9 billion. However, between 2021 and 2024, the gap widened significantly—not due to Okomu’s decline, but because Presco mastered profitability strategies that allowed it to consistently outperform expectations.

Presco, a major Nigerian oil palm producer, oversees over 26,000 hectares of plantations in Edo and Delta states—a land area significantly larger than the Dangote Refinery complex. Originally owned by the Bendel State Government, it later transitioned to Belgian-owned SIAT Group, before being acquired by Saroafrica International in 2024.

Despite Nigeria’s tough economic climate, Presco has navigated challenges strategically to maintain a steady profit trajectory. Based on a financial review, here are the three major strategies driving the company’s success.

1. Strategic Capital Investments Fuel Growth

At first glance, Presco’s financial success might seem linked to global palm oil price fluctuations. Palm oil prices peaked at $1,700 per tonne in 2022 before falling to $780 per tonne in 2023. However, since Nigeria remains a net importer, with annual production of just 1.5 million tonnes compared to a 3 million-tonne demand, export revenue was never the primary driver behind Presco’s growth.

Instead, the company’s rise can be attributed to strategic capital investments. Between 2020 and 2024, Presco invested a staggering N105.2 billion in capital expenditures, with N67.5 billion spent in 2024 alone. A significant portion of this investment went into acquiring a majority stake in Ghana Oil Palm Development Company, expanding Presco’s influence beyond Nigeria.

With an average Return on Invested Capital (ROIC) of 20% over this period, Presco is a prime example of efficient spending and smart reinvestment. These well-calculated investments have propelled the company’s total assets from N73.8 billion in 2020 to N422 billion in 2024, a fivefold increase.

2. Optimising Operating Expenses for Higher Profitability

A company’s Operating Expenses Ratio (OER) determines how much of its revenue is spent on running daily operations. In the agricultural and palm oil industry, an optimal OER typically falls between 20% and 30%.

Between 2020 and 2023, Presco’s OER fluctuated between 30% and 22%, but in 2024, it dropped to an industry-low 18%. This decline indicates that Presco has significantly improved cost management, ensuring that a larger portion of its revenue is retained as profit.

By maintaining an OER below industry benchmarks, Presco has ensured sustained profitability, allowing it to outpace competitors in financial performance.

3. Minimising Foreign Exchange (FX) Exposure

Unlike many Nigerian companies that have struggled with exchange rate volatility, Presco has taken deliberate steps to limit its exposure to foreign currency risks. By avoiding FX-denominated loans and foreign currency obligations, the company has protected itself from the financial strain caused by Naira depreciation.

This strategy has provided stability, ensuring that earnings remain strong regardless of currency fluctuations—a key factor behind the company’s consistent profit margins.

2020-2024: A Golden Era for Presco

Between 2020 and 2024, Presco has maintained an exceptional revenue growth trend, nearly doubling its earnings year after year:

- 2020: N23.9 billion

- 2021: N47.4 billion

- 2022: N81 billion

- 2023: N102.4 billion

- 2024: N198.2 billion

However, beyond revenue growth, Presco’s profitability metrics set it apart from industry peers like Okomu Oil Palm and Okitipupa Oil Palm.

- Gross Profit Margin: 66% (five-year average)

- Net Profit Margin: 41%, compared to Okomu Oil Palm’s 25% and Okitipupa Oil Palm’s 28%

- Return on Equity (RoE): Climbed from 18% in 2020 to 91% in 2024—one of the highest in Nigeria

- Return on Assets (RoA): Increased from 7% in 2020 to 35% in 2024, reflecting optimal resource utilization

The Big Question: What’s Driving Presco’s Success?

Presco’s financial performance over the past five years has been nothing short of impressive. But beyond the numbers, its commitment to strategic investments, cost efficiency, and risk management has played a crucial role.

By maintaining a low operating expense ratio, making smart capital investments, and limiting FX exposure, Presco has not only survived economic fluctuations but has emerged as a leader in Nigeria’s oil palm industry.