Record-Breaking Profits Despite Economic Challenges

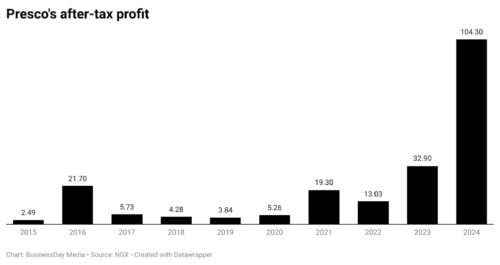

Okomu Oil and Presco Plc, two agro-based companies listed on the Nigerian Exchange Group (NGX), have posted their highest after-tax profits in a decade as of 2024. Despite inflation and currency devaluation, these firms demonstrated resilience, achieving remarkable growth. Presco saw a staggering 4,088.7% increase in profit since 2015, while Okomu Oil recorded an 1,188.3% surge.

Edo State: A Key Player in Oil Palm Production

According to Femi Oke, Chairman of the All Farmers Association of Nigeria (Lagos/Southwest Zone), Edo State remains Nigeria’s leading oil palm-producing region due to its fertile land. “The state hosts major producers like Okomu Oil and Presco, yielding the highest quality oil,” he explained.

Government Reforms Boost Production

Former Edo State Governor Godwin Obaseki previously highlighted reforms in the agricultural sector aimed at enhancing palm oil production. Edo now contributes approximately 12% of Nigeria’s total output, followed by Akwa Ibom and Cross River states, which collectively contribute between 5% and 8%.

Through the Edo State Oil Palm Programme (ESOPP), over 70,000 hectares have been allocated for cultivation, attracting over $500 million in investment—the largest in sub-Saharan Africa.

Expanding the Agro-Industrial Landscape

Beyond Okomu and Presco, Edo State has become a hub for agribusiness, hosting over ten companies. These include Dufil Prima Foods (makers of Indomie Noodles), Saro Oil Palm, Flour Mills Nigeria Plc, and American firm Fayus.

Impressive Financial Performance

In 2023, Okomu Oil’s profit grew by 61.9% year-on-year, while Presco Plc recorded a 217% increase. Both companies reported revenue growth despite inflation and currency depreciation, proving their resilience in a volatile economic climate.

While many consumer goods firms struggled with losses, these two agro giants continued to thrive. As of February 28, 2025, Okomu Oil traded at N545 per share, while Presco’s stock stood at N785.

Presco’s Bold Move in Capital Markets

Presco Plc, Nigeria’s largest palm oil producer, plans to raise N100 billion in Series 1 of its N150 billion bond program—the biggest corporate bond issuance in the industry. The seven-year bond offers a yield range of 23.25% to 23.75%.

Rated “Aa” by Agusto & Co. and “A-” by GCR, Presco’s strong credit profile bolsters investor confidence. This marks its second market venture after raising N34.5 billion in 2022 through a similar bond issuance.

Industry Overview: A History of Growth and Challenges

Okomu Oil, incorporated in 1979, and Presco, founded in 1991, both operate integrated oil palm plantations, refining facilities, and crushing plants. While Nigeria remains the continent’s top consumer of palm oil, the industry still faces challenges, including insecurity, high fertilizer costs, and inadequate transport infrastructure.

Henry Olatunoye, former President of the National Palm Produce Association of Nigeria (NPPAN), warned that Naira devaluation has made local investments less attractive compared to dollar-denominated ventures.

The Need for Strategic Investment

Alphonsus Inyang, NPPAN’s President, emphasized that Nigeria spends $600 million annually on palm oil imports. He urged the government to invest in local production to save costs and strengthen the economy. Due to years of neglect, Nigeria has fallen behind global leaders like Indonesia, Malaysia, Thailand, and Colombia in palm oil production.

Presco’s Financial Performance

Presco Plc reported a net profit of N104.3 billion in the first nine months of 2024, up from N32.9 billion in the same period in 2023. Revenue jumped to N198.2 billion, with domestic sales reaching N179.2 billion and Ghanaian sales at N18.9 billion. The company’s earnings per share increased to N10.43 from N3.29.

Okomu Oil’s Strong Results

Okomu Oil’s after-tax profit rose to N34.3 billion in 2024 from N21.2 billion in 2023. Revenue climbed to N130.1 billion, driven by local sales of N107.5 billion and export sales of N22.5 billion. Earnings per share surged to N35.93 from N22.19.

Conclusion: A Promising Future for Nigeria’s Palm Oil Sector

With increasing investment and expanding production, Nigeria’s palm oil sector shows strong growth potential. However, addressing infrastructure challenges and reducing reliance on imports remains crucial for sustained development.