Mounting Financial Pressure

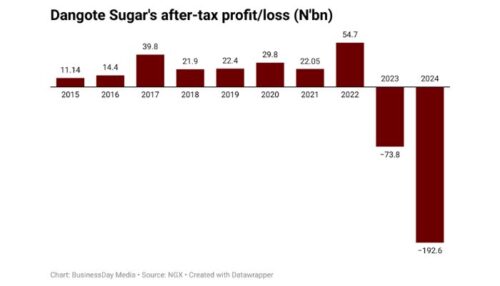

Dangote Sugar Refinery Plc has reported a deeper after-tax loss in 2024. High production costs and foreign exchange (FX) losses remain the biggest challenges. The company has now recorded two consecutive years of losses.

Despite this, analysts remain hopeful. They believe a stable naira and lower inflation could help reverse the losses.

Rising Costs Push Losses Higher

After-tax loss jumped to N192.6 billion in 2024 from N73.8 billion in 2023. The sharp decline reflects naira volatility and surging production expenses.

According to CardinalStone analysts, the company’s FY 2024 audited results highlight costly FX exposure and rising operational expenses:

Revenue Grows but Fails to Offset Losses

Despite financial struggles, revenue increased by 51%, driven by price hikes.

However, high revenue was not enough to cover ballooning costs and FX-related losses.

Borrowing and Debt Trends

Dangote Sugar showed some improvement in cash flow. Net cash grew to N38.2 billion in 2024, compared to a net borrowing of N204.2 billion in 2023.

Impact of FX and Operating Costs

The company relies heavily on imported sugarcane, making it vulnerable to FX fluctuations.

According to Proshare, rising finance costs and high administrative expenses worsened the situation.

Efforts to Boost Revenue

Dangote Sugar adjusted wholesale and retail prices, driving a 50.8% revenue increase to N665.69 billion.

Still, cost pressures and currency volatility offset these gains.

Declining Financial Ratios

Key performance indicators continued to drop:

✔ Return on Assets (ROA) fell to -18.34% in 2024 from -12.28%

✔ Return on Equity (ROE) declined to -90.8% from -93.07%

✔ Net Profit Margin worsened to -28.9% from -16.7%

Finance income also fell by 27.9% to N7.61 billion, as interest earnings on bank deposits declined.

Global Sugar Market Challenges

While rising global sugar prices benefited producers worldwide, Dangote Sugar missed out. Nigeria’s failure to meet local production targets under the National Sugar Master Plan (NSMP) limited its ability to capitalize on the price surge.

Extreme weather conditions further hurt sugarcane production. Meanwhile, India’s sugar export ban in 2024 drove prices even higher, adding to Nigeria’s import struggles.

Future Outlook and Expansion Plans

Dangote Sugar is pushing for growth despite its financial struggles. The company aims to produce 1.5 million metric tons (MMT) of refined sugar from locally grown sugarcane.

With its backward integration plan, it hopes to become a fully integrated global producer. Analysts believe that stable exchange rates and improved local production could help the company return to profitability.