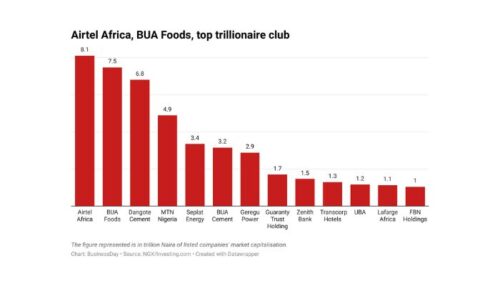

After a challenging 2024—marked by soaring diesel prices, exchange rate losses, and escalating production costs—the Nigerian economy is seeing a resurgence. Thirteen companies have now crossed the trillion-naira market capitalization threshold, signifying their dominance in the Nigerian Exchange Limited (NGX) and highlighting the nation’s growing influence on the global stage.

The combined market valuation of these top-performing companies in the NGX30 reached an impressive ₦44.4 trillion. Leading the pack are Airtel Africa, BUA Foods, and Dangote Cement, with market capitalizations of ₦8.1 trillion, ₦7.5 trillion, and ₦6.8 trillion, respectively. These industry leaders have demonstrated resilience and adaptability in a volatile economic landscape.

Airtel Africa:

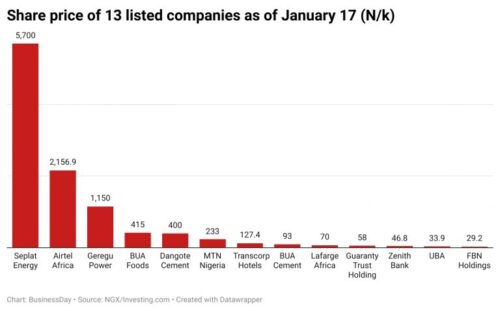

Airtel Africa takes the top spot with a market valuation of ₦8.1 trillion as of January 17, 2025. The telecommunications giant experienced a 7.8% surge in its share price, reaching ₦2,156.90 compared to ₦2,000 at the same time last year. The company’s revenue for the first half of 2024 stood at $2.3 billion, marking a significant recovery from a $13 million net loss recorded in the prior financial year.

BUA Foods:

Following closely, BUA Foods boasts a market value of ₦7.5 trillion. The company’s share price skyrocketed by 72.9%, supported by a 104% increase in revenue to ₦1.07 trillion. Net profit after tax surged by 91% to ₦201.4 billion, reflecting strong operational performance in the consumer goods sector.

Dangote Cement:

Dangote Cement remains a key player with a valuation of ₦6.8 trillion. Despite a minor decline in share price, the company reported ₦2.5 trillion in revenue for the first nine months of 2024, driven by robust local sales. After-tax profit grew marginally by 0.55% to ₦279.09 billion.

Broader Economic Indicators:

According to Nigeria’s National Bureau of Statistics (NBS), the country’s GDP in the service sector grew by 3.46% year-on-year in Q3 2024. Additionally, an upcoming rebasing of the GDP and Consumer Price Index (CPI) aims to provide a more accurate representation of the economy’s structure. Sectors like telecommunications, real estate, and trade have emerged as top contributors, with crude petroleum and natural gas taking a backseat.

Other Notable Companies in the Trillion-Naira Club:

- MTN Nigeria: Market valuation of ₦4.9 trillion, driven by a revenue increase to ₦2.37 trillion in 2024.

- BUA Cement: Valued at ₦3.2 trillion, despite a dip in profits due to rising input costs.

- Seplat Energy: Secured ₦3.35 trillion in market capitalization, with a revenue boost to ₦1.07 trillion.

- Zenith Bank: Achieved ₦1.5 trillion in valuation, reflecting an impressive 91% increase in after-tax profits to ₦827 billion.

- Transcorp Hotel: Reported a ₦1.3 trillion valuation, supported by a 148% jump in net profits.

Strategic Implications:

Analysts believe the continued expansion of Nigeria’s leading sectors will not only attract increased foreign direct investment but also inspire other industries to innovate and compete. The rise of these trillion-naira companies underscores Nigeria’s potential to solidify its position as a powerhouse within Africa’s economic landscape.

As these firms leverage strategic leadership, innovation, and an acute understanding of the market, they stand as a testament to Nigeria’s resilience and capacity for growth in the face of economic challenges.