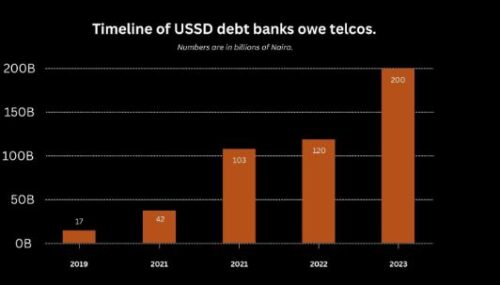

Nigerian banks and telecom operators have been embroiled in a long-standing dispute over USSD banking fees. The banks owe telcos approximately ₦200 billion for using the USSD platform, a service that has been crucial for financial inclusion in Nigeria.

Despite regulatory intervention and a payment plan, the banks have been slow to settle the debt. This delay is attributed to several factors:

- Disputed Liability: Banks argue that they should not be solely responsible for collecting and remitting USSD fees, as they do not directly profit from the service.

- Lack of Transparency: Banks question the transparency of the billing process and the accuracy of the calculated debt.

- Prioritization of Other Channels: With the rise of mobile banking and other digital payment methods, banks are prioritizing these channels over USSD, which they perceive as less profitable.

- Cost of Data: Banks believe that reducing data costs would encourage customers to shift to more profitable digital channels, diminishing the reliance on USSD.

While telcos argue that USSD remains an important channel for financial inclusion, especially for those with limited access to smartphones and the internet, the banks’ stance suggests a declining interest in the service.

As the dispute continues, it remains to be seen whether the banks will accelerate their payment efforts or if the issue will be further delayed. The resolution of this matter will have significant implications for the future of digital financial services in Nigeria.