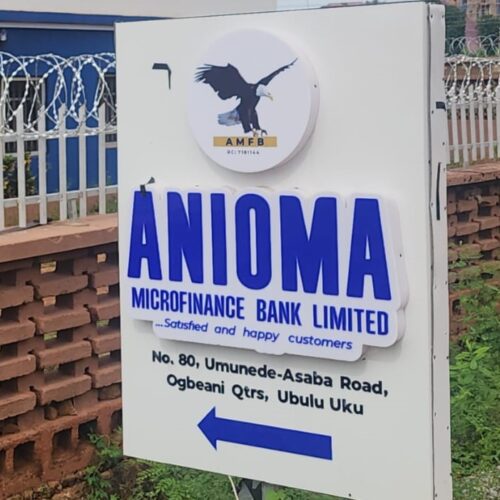

In a bid to catalyze economic growth and promote financial inclusion across Delta State, the town of Ubulu-Uku in Aniocha South Local Government Area welcomed a significant development with the commissioning of Anioma Microfinance Bank Limited on Monday.

The inauguration, officiated by the Commissioner for Information, Dr. Ifeanyi Osuoza, signals a new era of accessible banking for residents of Ubulu-Uku and nearby communities. The establishment of the microfinance bank aligns with Governor Sheriff Oborevwori’s MORE Agenda, which emphasizes meaningful development across all regions of the state.

Dr. Osuoza expressed his enthusiasm for the project, highlighting its strategic importance. “At a time when grassroots communities are seeking investments that drive growth and commerce, the creation of Anioma Microfinance Bank Limited is both timely and commendable. Positioned in the heart of Aniocha land, this institution offers a much-needed alternative for modern financial services that were previously accessible only in urban centers,” he stated.

The bank’s location makes it particularly advantageous for surrounding communities, including Ogwashi-Uku, Obior, Issele-Uku, and Ubulu-Unor, providing residents with seamless access to innovative banking solutions. According to Dr. Osuoza, the bank promises a blend of professional services, advanced banking technology, and diverse financial products typically associated with major commercial banks.

Chairman of the Board of Directors, Mr. C.M.O. Mordi, a former Director of Research at the Central Bank of Nigeria (CBN), shared the journey behind the bank’s establishment. After receiving preliminary approval from the CBN on September 20, 2023, and undergoing a thorough inspection on March 1, 2024, the bank was granted final approval on May 1, 2024.

Equipped with Automated Teller Machines (ATMs)—the first in the area—the bank’s issued cards are designed for universal usage, allowing customers to conduct transactions both locally and internationally. “Our mission is to bring accessible banking services to rural communities, offering savings accounts, loans, and business support programs that previously required travel to urban areas,” Mr. Mordi explained.

Representing the Obi of Ubulu-Uku at the event, Palace Secretary Barrister Obazei appealed for the bank’s loan offerings to prioritize local entrepreneurs, further enabling economic empowerment within the community.

The unveiling ceremony concluded with a formal commissioning of the bank by Dr. Osuoza and a guided tour of the facility, showcasing its state-of-the-art features and customer-friendly infrastructure.

With its establishment, Anioma Microfinance Bank Limited is poised to play a transformative role in the region, enhancing financial accessibility and fostering economic growth in Ubulu-Uku and its neighboring towns.