Strong Profit Growth Despite Economic Challenges

Nigerian cement manufacturers recorded significant profit growth in 2024, driven by price increases despite economic hurdles. Analysts expect continued investor interest in their stocks.

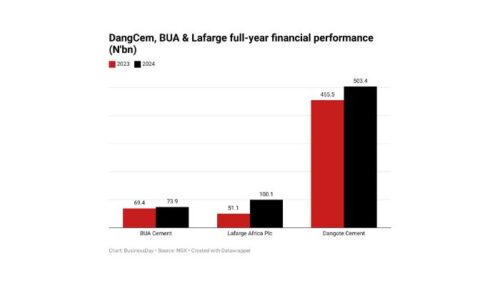

An analysis of unaudited financial statements from Dangote Cement Plc, BUA Cement Plc, and Lafarge Africa Plc reveals a combined after-tax profit of N677.48 billion. This marks a 17.6% rise from N576 billion in 2023. The surge is attributed to price adjustments aimed at countering inflation and rising operational costs.

Revenue Breakdown Among Cement Giants

Dangote Cement led the sector with a profit of N503.4 billion. Lafarge followed with N100.1 billion, while BUA Cement recorded N73 billion. Revenue growth played a key role in these gains.

The combined revenue from cement sales jumped 68%, reaching N5.15 trillion from N3.06 trillion. According to Dangote Cement’s CEO, Arvind Pathak, the company remained committed to innovation and value creation despite economic pressures. He noted a 62.2% increase in group revenue, fueled by higher sales volumes and strategic price adjustments.

Market Trends and Future Projections

CardinalStone Research analysts project stronger revenues for the cement sector in the second half of 2024. This growth is expected due to increased demand from public sector projects and government infrastructure spending.

However, rising energy prices, higher haulage costs, FX losses, and increased tax rates could put pressure on profit margins. Analysts also highlighted that the Federal Government’s N10 trillion capital expenditure in the 2024 budget, along with an N6.2 trillion supplementary budget, would likely sustain demand.

Company Performance Overview

Dangote Cement

Dangote Cement saw a 62.7% revenue rise, reaching N3.58 trillion from N2.2 trillion in 2023. The company’s profit after tax stood at N503 billion, with production costs hitting N1.64 trillion.

Stock prices climbed 50% in 2024, closing at N478.80 per share on December 27, up from N319.80 in January. This boosted the company’s market capitalization to N8.07 trillion, adding approximately N2.689 trillion in value.

The company’s board recommended a dividend of N30 per share for 2024, maintaining the same level as in 2023 to reinforce investor confidence.

BUA Cement

BUA Cement’s revenue surged 90.8%, reaching N876 billion from N459 billion in 2023. Its after-tax profit increased by 6.4% to N73.9 billion from N69.4 billion in 2023.

The board proposed a dividend of N2.05 per share for the 2024 financial year, up from N2.00 in 2023. However, BUA Cement’s stock price dropped by 8.8%, closing at N93 per share from N102 at the start of the year.

Lafarge Africa

Lafarge Africa reported a 71.8% revenue increase, reaching N696.7 billion from N405.5 billion in 2023. Profit after tax nearly doubled, rising to N100.1 billion from N51.1 billion.

Its stock price soared by 120.1%, closing at N69.34 per share, up from N31.50. The market capitalization hit N1.17 trillion as of December 27. Lafarge also proposed a final dividend of 120 kobo per share for 2024.

Industry Trends and Market Impact

According to the Central Bank’s Purchasing Manager Index, cement sector growth hit a record 60 points in January, the highest since October 2024. Any reading above 50 indicates expansion.

Meanwhile, cement prices fluctuated, jumping from N7,500 per 50kg bag back to N8,500 in November. This marks the fourth major price increase in a year, with costs nearly doubling from N4,500 at the start of 2024.

Industry experts link these price hikes to market monopolies, currency fluctuations, and high energy costs. With only three major producers—Dangote, BUA, and Lafarge—controlling 95% of production, price adjustments remain a key factor in profitability.