Strong Performance Despite Economic Challenges

Chams Holding Company Plc, a leading technology solutions provider, recorded a remarkable 218% increase in after-tax profit for the 2024 financial year. This growth, driven by heightened demand, underscores the company’s resilience despite economic challenges that disrupted many businesses.

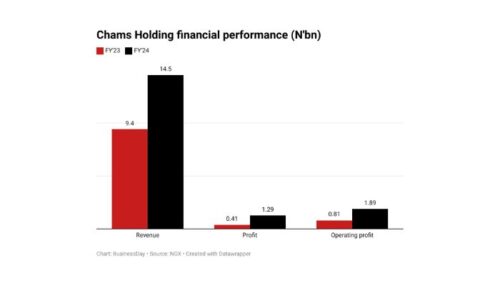

After-tax profit surged from N407.6 million in 2023 to N1.3 billion in 2024. The company’s strategic initiatives and operational efficiency played key roles in this impressive performance.

Revenue Growth Across Key Segments

Chams Holding’s revenue climbed 53%, reaching N14.51 billion in 2024, up from N9.47 billion the previous year. This increase resulted from strong performances across multiple business segments:

- Printer Solutions & Access: N7.31 billion

- Card Personalisation & Printing: N6.48 billion

- Payment Systems Solutions: N239 million

- Agency Banking & Mobile Money Operations: N475 million

While the cost of sales rose to N10.1 billion from N7.3 billion in 2023 due to expansion efforts, gross profit still increased significantly, reaching N4.37 billion from N2.1 billion.

Cost Management and Operating Profit

Effective cost management contributed to the company’s success. Administrative expenses stood at N1.54 billion, while marketing expenses amounted to N274.1 million. Despite these costs, operating profit more than doubled, rising from N809 million in 2023 to N1.89 billion in 2024.

Earnings Growth and Shareholder Value

Earnings per share (EPS) jumped from N4.53 kobo to N23.07 kobo, reflecting stronger profitability and increased shareholder value. Total assets also grew from N18.9 billion to N21.08 billion, fueled by higher trade receivables (N6.7 billion), investments in property, plant, and equipment (N3.3 billion), and increased cash reserves (N2.37 billion).

Although total liabilities rose to N10.12 billion, net assets improved, reaching N10.96 billion. The company maintained strong liquidity, with cash and cash equivalents rising from N1.89 billion to N2.37 billion. Total equity also strengthened, increasing from N9.54 billion to N10.96 billion.

Investments in Technology and Financial Services

Chams Holding continues to expand its presence in Nigeria’s digital economy. Investments in agency banking, mobile money operations, and payment systems align with its strategy to drive financial inclusion and capitalize on fintech opportunities.

Additionally, the company secured an N1.98 billion long-term loan to support expansion projects, technological upgrades, and strategic initiatives aimed at sustaining future growth.