Churpy, a Kenyan fintech startup, is scaling up its operations across Africa with the support of $1 million in seed funding. The company plans to establish regional hubs in Egypt, Nigeria, and South Africa to accelerate its growth and expand its innovative solutions.

Streamlining Accounts Receivable for Businesses

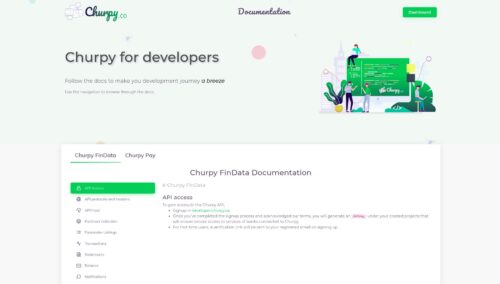

CPhurpy offers a SaaS product that automates accounts receivable processes, including the reconciliation of incoming payments and invoices. This technology replaces traditional manual methods, which are often time-intensive and error-prone, by integrating seamlessly with enterprise resource planning (ERP) systems. Businesses using Churpy’s platform gain access to real-time transaction data through API connections with major banks like Citibank, Stanbic, Sidian, and NCBA.“Our goal is to provide businesses with tools that enhance their operational efficiency and help them focus on strategic roles,” said John Kiptum, Churpy’s co-founder and CEO.

Enabling Real-Time Financial Insights

Through its platform, companies can track who owes them money, monitor liquidity, and evaluate the efficiency of their debt collection processes. The solution is already being tested by prominent Kenyan enterprises, including Unga Limited and Chandaria Industries.

“We allow chief financial officers and accountants to make informed decisions by presenting operational metrics in a clear and actionable format,” Kiptum added.

Bridging the SME Financing Gap

Churpy is also set to introduce a working capital financing product aimed at small and medium-sized enterprises (SMEs). This offering allows SMEs to receive immediate payment for goods supplied to Churpy’s partner enterprises, significantly reducing the traditional waiting period of up to two months.

“SMEs are critical to supply chains but often struggle with cash flow due to delays in payment. By offering quick access to funds at a nominal fee, we’re addressing a major financing gap,” explained Kennedy Mukuna, Churpy’s co-founder and head of product.The startup has partnered with several banks to facilitate this service. Trade Development Bank has allocated $15 million to Churpy for lending through its banking network, further enabling SMEs to meet their capital needs.

Backed by Strategic Investors

Churpy’s recent seed funding round was led by Unicorn Growth Capital, with contributions from Antler East Africa, Nairobi Business Angel Network, and Rally Cap Ventures.Unicorn Growth Capital’s founding partner, Barbara Iyayi, highlighted Churpy’s potential: “They are uniquely positioned to modernize B2B payment operations in underpenetrated markets and address the significant credit gap SMEs face in supplier financing.

”With plans to expand its team and enhance its product offerings, Churpy is well-positioned to lead in accounts receivable automation and embedded financial solutions. The startup is betting on its deep understanding of banking inefficiencies and the operational challenges faced by businesses to carve a niche in the African fintech landscape.