Emata, a fintech startup based in Uganda, is revolutionizing the way smallholder farmers access finance. By leveraging technology and innovative financial solutions, Emata is addressing the critical issue of financial exclusion in the agricultural sector.

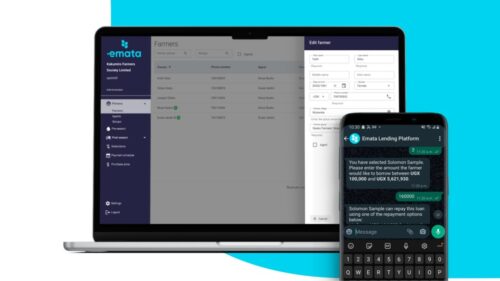

Traditional financial institutions often overlook smallholder farmers due to perceived risks and high transaction costs. Emata, however, has found a way to bridge this gap by partnering with farmer cooperatives and utilizing digital technology. By collecting and analyzing data on farmers’ performance and creditworthiness, Emata can assess risk and make informed lending decisions.

The startup’s innovative use of WhatsApp chatbots has streamlined the loan application and disbursement process, making it more accessible to farmers in remote areas. By leveraging mobile money platforms, Emata ensures that farmers can easily receive and repay loans.

Emata’s impact extends beyond providing financial services. By empowering farmers with access to capital, the company is contributing to increased agricultural productivity, improved livelihoods, and food security in Uganda. As Emata expands its operations to other African countries, it has the potential to transform the lives of millions of smallholder farmers across the continent.