Access Corporation, a major player in Nigeria’s banking industry, has launched Hydrogen, a fintech company aiming to revolutionize the country’s payments landscape. With a focus on building a robust payment infrastructure, Hydrogen seeks to power a wide range of transactions, from small-scale purchases to large-scale corporate payments.

In just a short span of time, Hydrogen has made significant strides. The company has introduced a suite of products designed to cater to both merchants and consumers. For merchants, Hydrogen offers a range of solutions, including POS terminals, payment gateways, and instant payment services. This enables businesses of all sizes to accept payments seamlessly, whether online or offline.

On the consumer side, Hydrogen is focused on providing efficient and secure payment options. The company’s card and switch business empowers financial institutions to process transactions smoothly, while its interbank transfer and bulk payment services facilitate seamless fund transfers.

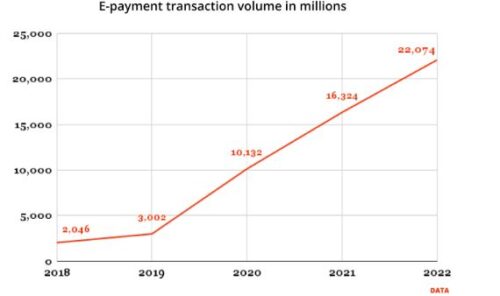

As the Nigerian digital payments market continues to grow, Hydrogen is well-positioned to capitalize on this opportunity. By leveraging its strong backing from Access Corporation and its innovative approach to payment solutions, Hydrogen aims to become a dominant force in the industry.

However, the company faces stiff competition from established players such as Flutterwave, Paystack, and Moniepoint. To differentiate itself, Hydrogen must continue to innovate, offer competitive pricing, and provide exceptional customer service.