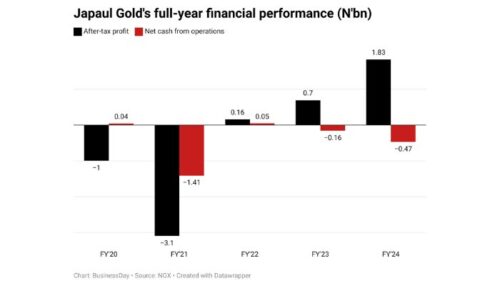

Japaul Gold and Ventures Plc has posted an impressive billion-naira profit for the 2024 financial year, marking its highest earnings in five years. However, a closer look at the company’s financials reveals that its core business activities did not generate positive cash flow, raising questions about the sustainability of its profitability.

An analysis by BusinessDay indicates that Japaul Gold’s after-tax profit surged by 183%, climbing from N695 million in 2023 to N1.83 billion in 2024. Despite this significant increase in profit, the company reported negative cash flow from operations, recording a loss of N468 million, a sharp contrast to the N158 million positive cash flow it achieved the previous year. This suggests that Japaul Gold’s main business lines are not generating enough cash to sustain its operations.

To navigate these financial challenges, the company has focused on offshore activities, which have become a major driver of revenue. While Japaul Gold’s N4.12 billion turnover in 2024 reflects growth, 83% of this revenue came from its offshore subsidiary, overshadowing its core businesses—Japaul Dredging and Japaul Quarry—which contributed N527 million and N164 million, respectively.

Stock Performance and Market Activity

Japaul Gold has remained an actively traded stock throughout the year, averaging 14.2 billion shares in trading volume since January. Notably, on January 24, the stock saw a surge in activity, with 34.6 million shares changing hands in a single day.

Since the beginning of 2024, the company’s stock price has gained 7%, opening the year at N2.14 and reaching a year-high of N2.30 on January 6. However, by the end of the financial year, Japaul Gold’s share price had dipped slightly, closing at N2.05.

Strategic Investments and Expansion Plans

Japaul Gold has been making strategic investments to strengthen its asset base. The company’s total asset acquisition grew by 132.8%, rising from N14.3 billion in 2023 to N33.27 billion in 2024. A breakdown of its financials shows that non-current assets stood at N16.2 billion, while current assets were valued at N17 billion by the end of the year.

Despite a challenging economic environment, Japaul Gold demonstrated resilience by successfully turning a previous equity deficit of N-800 million into a positive N18.9 billion, thanks in part to its increased share premium. Additionally, the company managed to cut costs significantly, reducing administrative expenses from N11.02 billion in 2023 to N875 million in 2024—a substantial cost-saving measure.

New Projects to Sustain Growth

In a recent corporate disclosure on the Nigerian Exchange Group (NGX), Japaul Gold announced a major contract that could further stabilize its financial position. The company signed a N26 billion sand mining contract with Gravitas Investment Limited, the developers behind Gracefield Island.

Under the contract, Japaul Gold will extract 3.5 million cubic meters of sand for land reclamation at Gracefield Island, a premium development located at the end of Chevron Drive in Lekki, Lagos. The project, expected to last 26 months, will support the company’s revenue stream as it continues preparations for full-scale gold production.

According to Japaul Gold’s company secretary, Michael Edeko, this project is a crucial step in ensuring financial stability while positioning the company for long-term success in the mining sector.

As Japaul Gold navigates its mixed financial performance—balancing strong profit numbers with weak operational cash flow—industry analysts will be watching closely to see if its diversification strategy can lead to sustainable growth in the coming years.