Strong Interest Income Fueled by High-Yield Environment

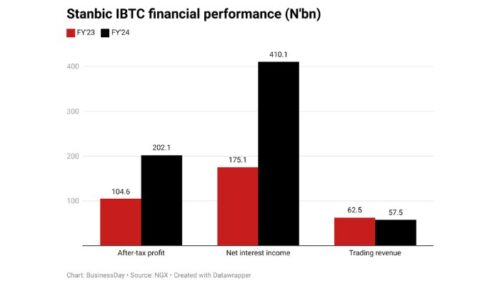

Stanbic IBTC Holding Company, a leading tier-two financial institution in Nigeria, recently published its full-year financial results for December 30, 2024. The bank’s after-tax profit surged by 43.7 percent, reaching N202.1 billion, compared to N140.8 billion in 2023. This impressive growth came from elevated interest rates in a high-yield market.

Higher Interest Rates Propel Revenue Growth

Interest income, calculated using the effective interest rate, climbed to N566 billion from N270 billion. A large share of this increase resulted from earnings on loans and advances, which made up 69 percent of the total interest income.

Analysts at CardinalStone Research noted that the high-interest environment pushed asset yields up from 11.3 percent to 17.5 percent. Additionally, the bank expanded its income streams, leading to a 173 percent surge in interest earned from investments and a 347 percent rise in interest from loans and advances to banks.

Despite a 63.5 percent rise in interest expenses, Net Interest Income (NII) soared by 134.3 percent to N410.5 billion. It solidified its role as the primary earnings driver, now accounting for 63.5 percent of total earnings, up from 49.3 percent in 2023 and 47.2 percent in 2022.

Corporate and Investment Banking Drives Profitability

A stronger focus on corporate and investment banking significantly boosted Stanbic IBTC’s earnings. In 2024, after-tax profit in this segment rose by 193 percent. However, interest expenses also climbed to N108.7 billion from N83.4 billion. Likewise, operating expenses increased to N98 billion, up from N57 billion.

The company’s financial report highlighted how its Corporate and Investment Banking (CIB) division serves multinational, regional, and domestic corporations, government bodies, and institutional clients. These clients rely on the bank’s expertise, sector knowledge, and access to global capital markets for advisory, transaction, trading, and funding solutions.

Decline in Trading Revenue

Despite strong overall performance, Stanbic IBTC experienced a 9 percent drop in trading revenue. The bank generated income only from fixed-income securities and currency trading during the period. Commodities and equities did not bring returns, but management remains optimistic about future revenue growth.

Strategic Plans for Growth

To strengthen its financial position, Stanbic IBTC launched a N148.7 billion rights issue, which began on January 15 and will close on February 21, 2025. The bank is offering 2,944,772,083 ordinary shares at N50.50 per share, with a ratio of five new shares for every 22 held as of October 29, 2024.

Currently trading at N59.5 per share, the bank’s stock is approaching its 52-week high of N65.4, well above its 52-week low of N45.

Allocation of Rights Issue Proceeds

Stanbic IBTC has outlined its plan for using the funds from its ongoing rights issue. About 27 percent will support business and commercial banking, focusing on small and medium-sized enterprises (SMEs), especially in the general commerce sector.

Additionally, 42 percent of the funds will go toward corporate and investment banking, targeting key industries such as manufacturing, power, agriculture, and telecommunications. Another 14.11 percent is designated for IT infrastructure upgrades, while 2.22 percent will help expand the branch network with technology-driven, environmentally sustainable facilities.

Through these initiatives, Stanbic IBTC aims to strengthen its market position, improve customer service, and drive economic growth across multiple sectors.