Despite a global slowdown in venture capital funding, the African tech ecosystem continued to demonstrate resilience in 2022, exceeding $5 billion in funding for the second consecutive year. However, the landscape is evolving, with a growing number of investors and a shift towards debt financing.

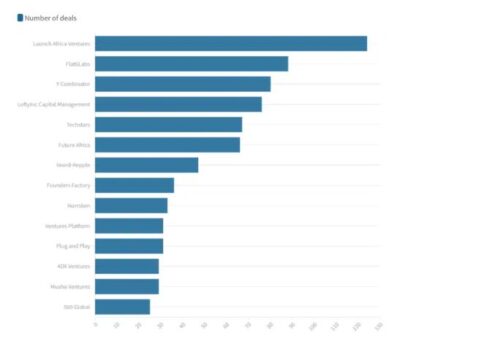

This analysis examines the most active investors in the African startup ecosystem over the past two years, revealing key trends and highlighting the prominent players driving innovation across the continent.

Launch Africa Ventures: A Leading Force

Launch Africa Ventures has emerged as a dominant force in the African venture capital scene, consistently ranking as the most active investor over the past two years. With over 120 deals across 19 countries, Launch Africa Ventures has demonstrated a strong commitment to supporting early-stage startups across the continent.

Key Players:

- Flat6Labs: Focusing primarily on the Middle East and North Africa region, Flat6Labs has invested in over 88 deals, primarily in Egypt and Tunisia.

- Y Combinator: A global powerhouse, Y Combinator has invested in 86 African startups, including notable successes like Flutterwave, Wave, and Paystack.

- LoftyInc Capital Management: This Nigeria-based firm has actively invested in 76 deals across 11 African countries, spanning sectors such as fintech, edtech, and e-commerce.

- Techstars: With a growing presence in Africa, Techstars has participated in over 67 deals, fostering innovation through its accelerator programs and partnerships.

- Future Africa: Founded by a prominent group of entrepreneurs, Future Africa has invested in 66 startups across seven countries, supporting promising ventures in sectors like fintech and agritech.

- Verod Kepple: This investment firm has invested in 47 deals across nine African countries, with a focus on sectors such as finance, healthcare, and technology.

- Founders Factory: This venture studio has invested in 36 startups across six African countries, providing comprehensive support to early-stage ventures.

- Norrsken: With its dedicated African Tech Growth Fund, Norrsken has invested in 33 deals across nine countries, focusing on Series A and B investments.

- Plug and Play: A global leader in innovation platforms, Plug and Play has invested in 31 deals across seven African countries.

Key Trends:

- Increased Investment Activity: Despite the global economic slowdown, the number of investors and deals in the African tech ecosystem continued to grow.

- Rise of Debt Financing: Debt financing witnessed a significant increase, particularly within the fintech sector.

- Focus on Early-Stage Investments: A significant number of deals involved investments in early-stage startups, highlighting the importance of nurturing early-stage innovation.

- Geographic Diversification: While Nigeria, Kenya, South Africa, and Egypt continue to attract significant investment, other countries are emerging as key players, including Morocco, Tunisia, and Rwanda.