On Monday, the Ministry of Finance Incorporated (MOFI) unveiled the N100 billion Series 2 offering under its Real Estate Investment Fund. This marks a critical step toward tackling Nigeria’s housing shortage, which is estimated at over 20 million units.

Building on Success: Series 2 Expands on Previous Launch

This second phase comes on the heels of the successful NGN150 billion Series 1 offering last year, bringing the total fund to N250 billion. With the goal of raising up to ₦1 trillion, the MOFI Real Estate Fund (MREIF) aims to transform Nigeria’s housing sector, enabling more Nigerians to own homes through affordable, long-term financing.

Affordable Mortgages with Long-Term Repayment Terms

The Series 2 offering presents an exciting opportunity, providing mortgage financing at interest rates between 11% and 12%, which is significantly lower than typical commercial rates. Moreover, it offers repayment terms of up to 25 years, making homeownership more attainable for a greater number of Nigerians.

Encouraging Private Sector Involvement in Housing Development

During the launch in Abuja, Finance Minister Wale Edun emphasized that this initiative isn’t just about providing affordable housing. Rather, it’s about encouraging private sector investment. The initiative aligns with President Tinubu’s Renewed Hope Agenda, aiming to boost infrastructure, create jobs, and strengthen the economy.

Series 2: A Collaborative Approach to Attract Private Sector Capital

Unlike Series 1, which was entirely funded by MOFI, Series 2 actively seeks private sector involvement. Through partnerships with fund managers, advisers, and issuing houses, MOFI aims to raise ₦100 billion from institutional investors via capital market channels. This marks a solid move toward fostering public-private partnerships that will drive economic growth and expand housing finance.

A Long-Term Vision for Affordable Homeownership

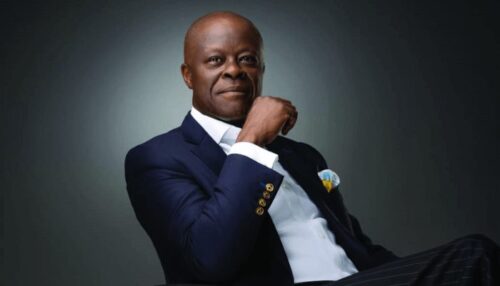

Armstrong Takang, MD/CEO of MOFI, stressed that Series 2 is pivotal in unlocking large-scale private capital for Nigeria’s housing sector. By using blended finance, the initiative aims to provide a sustainable framework for affordable homeownership that benefits all Nigerians.

Moving Forward with Mortgage Issuance

Once the funding goal is met, MOFI plans to start issuing mortgages through qualified financial institutions by the end of the month. However, MOFI clarified that its role is not to build houses or directly issue mortgages. Instead, MOFI works as a facilitator, creating secure investment instruments that encourage more investment in the housing market and help address the country’s housing deficit.

A Landmark Achievement for Nigeria’s Housing Sector

Shamsuddeen Usman, chairman of the MOFI board, hailed the initiative as a major achievement for Nigeria’s housing sector. He reiterated that the Renewed Hope Agenda aims to provide sustainable homeownership opportunities for Nigerians, with MREIF playing a vital role in realizing this vision.

Transforming Nigeria’s Housing Landscape

The fund’s partners are confident that achieving the ₦1 trillion target will stimulate significant investments, transforming Nigeria’s housing landscape and improving the lives of millions. Agama Emomotimi, Director-General of the Securities and Exchange Commission, remarked that such initiatives not only drive financial inclusion but also adhere to international best practices.

“We are leveraging the capital market to help propel Nigeria’s development,” Emomotimi concluded.