Surge in Mortgage Financing Amid Housing Demand

Nigerian mortgage banks are capitalizing on the increasing demand for property ownership, leading to significant growth in their loan offerings. Recent reports show a 43.5% rise in mortgage loans issued to customers, reflecting the sector’s expansion.

Mortgage Banks Report Strong Loan Growth

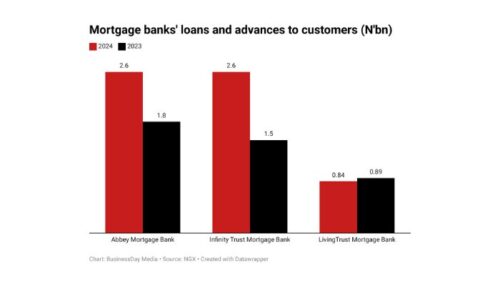

According to unaudited financial statements from three publicly listed mortgage banks—InfinityTrust Mortgage Bank, Abbey Mortgage Bank, and LivingTrust Mortgage Bank—total mortgage loans and advances climbed to N6 billion from N4.18 billion at the close of 2023. This surge highlights the growing enthusiasm among Nigerians to invest in real estate.

A mortgage is a debt instrument commonly used in the real estate sector, secured against property as collateral. Mortgage banks primarily offer home financing, financial consultancy, and construction funding services.

Despite economic uncertainties, real estate investments in 2024 have remained robust, ensuring long-term financial security and wealth creation.

Property Value Appreciation Boosts Investor Confidence

Lagos continues to be a hotspot for real estate investments, particularly in areas like Lekki, Ikoyi, and Victoria Island. In 2024, property values in these prime locations saw an average appreciation of 15%, with expectations of a similar trend in 2025. Investors seeking capital appreciation are increasingly turning to emerging urban districts for opportunities.

Mortgage Banks’ Interest Income Performance

Further analysis reveals a slight 2.2% dip in interest income from mortgage loans, contributing 32.2% of total interest earnings in 2024. Nevertheless, the net interest income for the three listed mortgage banks grew significantly, reaching N18.2 billion in 2024, up from N12.13 billion in 2023.

Breakdown of Mortgage Banks’ Financial Performance

InfinityTrust Mortgage Bank

InfinityTrust Mortgage Bank reported a rise in after-tax profit to N1.65 billion in 2024 from N1 billion in 2023. Pre-tax profit also climbed to N1.7 billion from N1.2 billion. Revenue expanded to N4.3 billion from N2.9 billion, while interest income increased to N3.4 billion from N2.5 billion.

The bank’s total assets grew to N24.6 billion from N20.6 billion, with dues from banks rising to N3.5 billion from N1.7 billion. Loans and advances to customers increased to N16.2 billion from N15.4 billion.

Abbey Mortgage Bank

Abbey Mortgage Bank saw its after-tax profit grow to N1.2 billion in 2024, up from N871.2 million in 2023. Pre-tax profit also rose to N1.28 billion from N951 million.

The bank’s interest income surged to N11.9 billion from N7.2 billion, while interest expenses jumped to N8.6 billion from N4.7 billion. Its total assets swelled to N83.3 billion from N57.5 billion, with dues from banks and financial institutions increasing to N24.9 billion from N12.7 billion. Investments in securities at amortized cost grew to N41.7 billion from N26.8 billion.

LivingTrust Mortgage Bank

LivingTrust Mortgage Bank recorded an increase in earnings, reaching N854.5 million in 2024 from N568.3 million in 2023. Pre-tax profit also rose to N911 million from N665.7 million.

Revenue grew to N3.7 billion from N2.9 billion, while interest income expanded to N2.9 billion from N2.4 billion. The bank’s total assets rose to N24.4 billion from N17.8 billion, with dues from banks increasing to N5.6 billion from N3.6 billion. Loans and advances to customers also climbed to N13.9 billion from N12.8 billion.