The Nigerian naira has kicked off the year with a remarkable appreciation, recording its strongest rally in 13 years. This surge, reminiscent of a similar rise in early 2024, raises questions about whether this time will yield sustained gains or follow a familiar pattern of reversal.

Naira’s Resurgence: A Promising Start

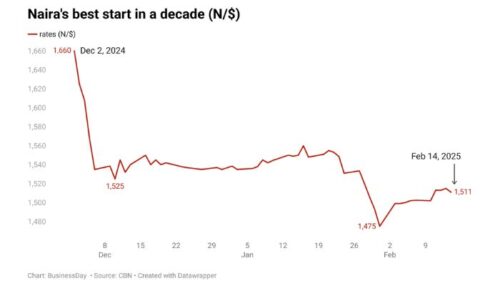

Since December 2024, the naira has appreciated by 9%, climbing from N1,662/$ on December 2 to N1,509/$ by February 13. This makes it Africa’s best-performing currency over the period, according to BusinessDay data.

In January alone, the naira strengthened by 4% (N63.14), reaching a seven-month high of N1,478.22/$. A similar January rally was last seen in 2012.

Although the pace of appreciation has moderated in February, the currency has continued to hold firm, stabilizing at N1,500/$ in the official market while strengthening in the parallel market to N1,545/$—an improvement from N1,620/$ at the start of the month.

Is This Another Temporary Surge?

The last time the naira appreciated at this rate, the gains proved short-lived. In March 2024, the currency rebounded from N1,600/$ in February to N1,300/$, fueled by foreign portfolio inflows (FPIs) and diaspora remittances. However, by July, it had plunged to N1,660/$, wiping out all previous gains.

Market analysts attributed the decline to profit-taking by foreign investors and reduced dollar supply. Many had entered at N1,600/$, only to exit at N1,300/$, securing substantial profits. Those investing in Nigerian bonds—following CBN’s interest rate adjustments—benefited even further.

“If the naira appreciates too fast, foreign investors might take advantage of the gains, just as they did last year,” a market expert explained.

To prevent a repeat of 2024’s cycle, the CBN appears to be controlling the pace of appreciation more carefully, which is evident in the currency’s measured performance in February.

Key Factors Driving the Naira’s Strength

Several factors have contributed to the naira’s impressive rally, most notably:

- Increased FX supply due to CBN reforms

- Greater transparency in the official FX market

- Rising investor confidence in Nigeria’s economic policies

According to FMDQ data, foreign exchange inflows into the Nigerian Autonomous Foreign Exchange Market (NAFEM) jumped by 53% in January, rising from $3.1 billion in December 2024 to $4.7 billion.

This increase in FX liquidity has helped stabilize the market, reducing pressure on the parallel exchange rate.

One of the key policy reforms credited with strengthening the naira is the Electronic Foreign Exchange Matching System (BMatch). Launched in December 2024, this CBN-backed platform—operating via Bloomberg’s BMatch system—allows dealers to place anonymous orders in a centralized order book, improving market efficiency and price transparency.

By minimizing distortions and allowing better oversight, the BMatch system has enhanced exchange rate management.

According to Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise (CPPE), improved access to accurate supply-demand data has reduced market uncertainty, making exchange rate fluctuations more predictable.

In January 2025, the CBN introduced another reform: the Nigeria Foreign Exchange Code (FX Code). This framework outlines best practices for ethical conduct, risk management, and governance in the FX market, aligning Nigeria’s policies with global standards.

As a further stabilization measure, the CBN extended its $25,000 weekly dollar sales to Bureau de Change (BDC) operators until May 2025, ensuring the parallel market does not disrupt official exchange rates.

External Reserves and Investor Sentiment

Despite these positive developments, Nigeria’s external reserves have continued to decline, dropping to $39.4 billion. A significant portion of the outflows in January resulted from:

- Nigeria’s repayment of its COVID-19 IMF facility

- CBN’s interventions in the FX market

To boost investor confidence, the CBN has announced plans to begin publishing net external reserves data. Currently, only a 30-day moving average of gross reserves is reported, leaving many foreign investors uncertain about Nigeria’s true FX liquidity.

According to Wale Okunrinboye, head of research at Access Pensions, greater transparency in reserve reporting could enhance market confidence. However, he cautioned that disclosing net reserves might also trigger volatility, as investors adjust their expectations regarding Nigeria’s FX position.

Will the Rally Last?

With the naira’s appreciation now in uncharted territory, the coming months will determine whether this rally is built on solid fundamentals or merely another short-lived surge.

If FX supply remains consistent and CBN reforms continue to gain traction, the naira’s gains could prove more sustainable than in the past. However, if foreign investors opt for profit-taking, the currency may once again face renewed pressure.