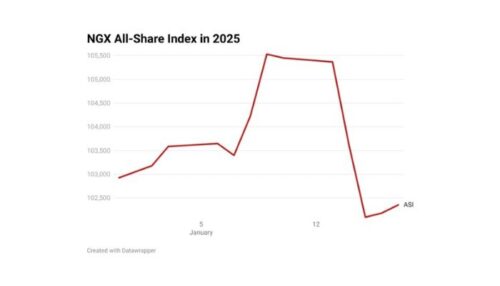

The Nigerian Exchange (NGX) has experienced a sluggish start to 2025, with analysts pointing to profit-taking and attractive fixed-income yields as the key reasons behind the downturn.

As of January 17, the All-Share Index (ASI) closed at 102,307.94 points, reflecting a 0.60% decline from its closing figure of 102,926.40 at the end of 2024. This marks the slowest yearly opening for the NGX since 2019.

In 2024, the market posted a remarkable 37.65% growth, with several listed stocks delivering extraordinary returns. For instance, Sunu Assurances recorded an 877% gain, while Oando and Conoil saw returns of 529% and 362%, respectively.

However, this momentum has not carried into the new year, as explained by Samuel Oyekanmi, a Research and Insight Associate at Norrenberger. He shared that the market is currently undergoing a correction following the significant rallies observed toward the end of 2024.

“It’s common for investors to reposition themselves early in the year, especially after taking advantage of the end-of-year market rally,” Oyekanmi noted. “Right now, we’re seeing profit-taking across stocks that performed well last year, leading to price adjustments.”

Fixed-Income Yields Draw Investor Interest

The auction of Treasury bills (T-bills) on January 8 has also contributed to the market’s slowdown. Despite a slight reduction in stop rates compared to previous auctions, T-bill yields remain relatively high. This has encouraged risk-averse investors to shift their funds from equities to fixed-income instruments, Oyekanmi explained.

Sunu Assurances, one of the top-performing stocks of 2024, has experienced a dramatic reversal, with its share price dropping by 38.4% year-to-date as investors capitalize on their earlier gains.

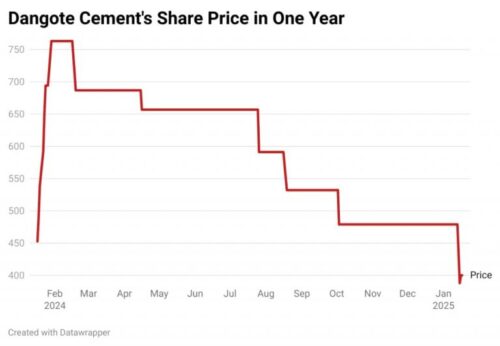

Focus on Dangote Cement

Another notable decliner is Dangote Cement (DANGCEM), which has seen its share price drop 16.5% so far in 2025. The stock hit a 53-week low on January 16 before recovering slightly to close at N400 per share.

According to Oyekanmi, there is no significant market development driving activity in Dangote Cement. He noted that the stock’s robust performance in early 2024 has now been corrected in the absence of new catalysts.

Oluwaseun Magreola, Head of Research and Investment at STL Asset Management, echoed these sentiments. “Nothing fundamental is currently affecting Dangote Cement, apart from possible portfolio rebalancing. While some investors have experienced losses, many remain confident in the stock’s long-term potential,” Magreola said.

Market Outlook

As the NGX navigates the first quarter of 2025, analysts believe that further clarity on fiscal policies, corporate performance, and global economic conditions will help shape investor sentiment. For now, the market appears to be consolidating as participants weigh their options between equities and fixed-income opportunities.