Naira’s Rally Not Driven by Direct CBN Intervention

The recent rise in the Naira’s value is not solely due to CBN’s foreign exchange interventions. Bismarck Rewane, CEO of Financial Derivatives Company, shared new data on Arise TV, dismissing earlier reports that the CBN injected $8 billion into the market.

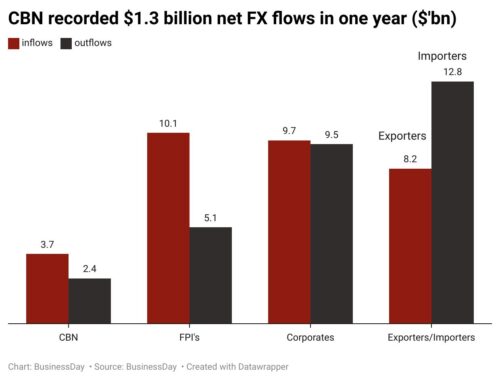

His findings show that since February 2024, the CBN sold only $3.7 billion in the Nigerian Autonomous Foreign Exchange Market (NAFEM). This accounts for just 11% of the $31.7 billion traded so far this month. During the same period, the CBN bought $2.4 billion, representing 8% of total outflows.

Breaking Down the Figures

Last week, Rewane claimed that $8 billion supported the Naira’s stability. However, he clarified that this amount includes external borrowings and bond issuances rather than direct interventions.

- Nigeria’s foreign reserves, once above $40 billion, have dropped.

- The country secured $4 billion through bond sales.

- Of the $8 billion mentioned, $3.1 billion came from foreign bonds, including $2.2 billion in Eurobonds and $900 million in domestic dollar bonds.

Meanwhile, CBN data shows that foreign reserves declined by only $2 billion this year, with a $850 million drop this month.

CBN’s Policy Strategy Is Working

Rewane stated that the CBN’s approach ensures external reserve stability while protecting the Naira’s value.

According to Purchasing Power Parity (PPP), the Naira’s fair value is ₦1,102 per dollar, making it undervalued by 26%. Supporting an undervalued currency corrects misalignment, which is exactly what the CBN aims to achieve.

“The policies are effective,” Rewane said. “The gap between the official and parallel markets has narrowed, market efficiency has improved, and money supply growth is now $74 billion.”

Naira Holds Steady Amid Market Changes

The Naira’s value has remained relatively stable. On Friday, it traded at ₦1,509 per dollar in the official market, while in the parallel market, it gained 2%, closing at ₦1,510 per dollar.

Does the CBN Need to Defend the Naira?

A finance analyst argued that the CBN does not need to defend the Naira aggressively since the black market rate closely matches the official rate.

- The ₦4 difference acts as a premium for Bureau de Change (BDC) transactions.

- A large gap would require CBN intervention.

However, if defending the Naira means CBN selling FX from federation earnings, Eurobond proceeds, and dollar-backed instruments, then this remains a normal policy practice.

The CBN’s strategic approach continues to focus on market stability and sustaining the Naira’s value without excessive intervention.