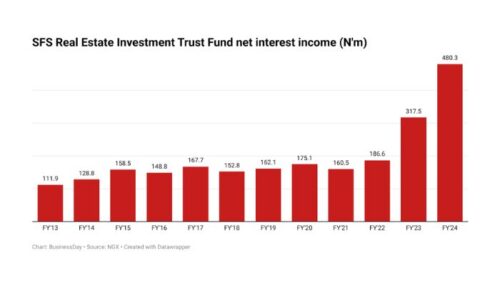

The SFS Real Estate Investment Trust Fund (SFS REIT Fund), Nigeria’s first publicly listed real estate investment trust, has recorded its highest net income in over a decade, based on an analysis by BusinessDay.

According to the company’s unaudited financial statement, the fund’s net income surged by 51.2% in 2024, reaching N480.3 million, up from N317.5 million in the previous year.

Launched through an Initial Public Offering (IPO) of 20 million units at N100 each in July 2007, the SFS REIT Fund was officially listed on the Nigerian Stock Exchange (NSE) in February 2008 at the same price. By January 2024, its share price stood at N101.38 and closed the year at N179.45, reflecting a 77% increase in value.

The fund targets a diverse range of investors, including pension fund administrators, asset managers, insurance companies, international investors, and individuals seeking stable returns from real estate assets.

With a focus on income-generating properties such as residential estates, shopping centers, offices, hotels, and warehouses, the fund leverages its tax-exempt status to maximize returns through rental income, property sales, and strategic asset management.

During the period under review, total income rose to N554.9 million from N395.4 million, driven by rental earnings, fixed interest income, and profits from property disposals. Rental income grew to N205 million from N190 million, fixed interest income increased to N176.5 million from N147.7 million, and gains from property sales jumped significantly to N172.4 million from N57.6 million.

Prime Property Holdings

The SFS REIT Fund’s portfolio includes high-value properties in key locations across Lagos and Abuja, ensuring strong rental yields. Some of the notable estates include:

- Victory Park Estate, Lekki-Lagos: 12 units, yielding 6.50%, with 11-year-old properties.

- Milverton Court Estate, Lekki-Lagos: 17 units, yielding 6.28%, with properties aged 6 years.

- Sapphire Gardens Estate, Awoyaya-Lagos: 6 units, yielding 5.60%, with corporate tenants.

- Bourdillion Court Estate, Chevron Drive, Lagos: 8 units, yielding 6%, with 4-year-old properties.

- Harold Shodipo, GRA Ikeja, Lagos: 6 units, yielding 4.30%, leased to corporate tenants.

- Maccido Royal Gardens Estate, Abuja: 2 units currently available for sale with no rental yield.

As of the 2024 financial year, the fund’s total assets increased to N3.47 billion from N3.3 billion in 2023. Investment properties made up 57% of total assets, while investment securities and cash accounted for 42.6% and 8.9%, respectively.

However, the fund’s cash flow saw a decline, with net cash from operations dropping to N188.9 million from N443 million in 2023. Cash reserves at the end of the period fell to N29.4 million from N755 million, primarily due to negative cash flows from investment and financing activities.

Despite these challenges, basic earnings per unit rose from N15.88 to N24.02, underscoring the fund’s profitability and growth potential in the real estate sector.