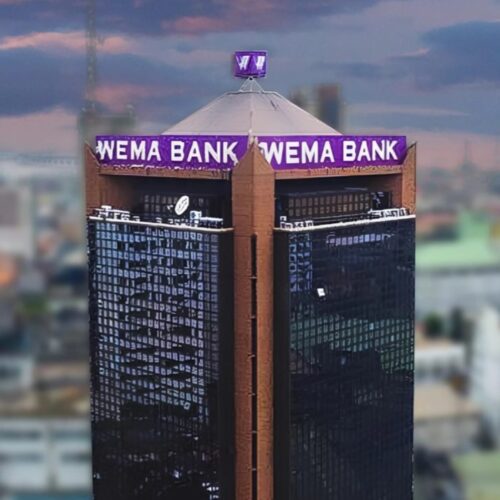

Wema Bank, a leading Nigerian commercial lender with a market capitalization of ₦260.38 billion, has introduced a salary increase for its workforce of over 1,700 employees, set to take effect in March 2025. According to sources familiar with the development, while the bank has not disclosed the exact percentage of the increment, the adjustment aligns with similar wage hikes across Nigeria’s banking sector as financial institutions compete for skilled professionals amid economic pressures.

With this revision, Wema Bank is now one of the highest-paying banks in Nigeria across several job tiers. Key changes include the increase of executive trainees’ salaries from ₦255,000 to approximately ₦541,000 (a 112% increase), assistant banking officers salaries from ₦681,000 to ₦830,000, banking officers salaries increased from ₦875,000 to ₦1.015 million while the senior banking officers had an increase from ₦1.07 million to over ₦1.2 million, surpassing the ₦1.1 million salary at Access Bank for the same level.

This marks Wema Bank’s second major salary increase in less than two years. In July 2023, the bank raised salaries by 45% across all employee levels, citing inflation and the rising cost of living. The adjustment followed government reforms that worsened economic hardship, prompting financial institutions to rethink their compensation structures.

However, the banking sector in Nigeria is facing an escalating talent war, driven by two key factors; fintech disruptions (fintech startups are actively attracting experienced banking professionals with higher salaries, flexible work conditions, and stock options) and brain drain (many skilled financial experts are relocating abroad in search of better economic opportunities, further tightening the talent pool).

Several financial institutions have responded by adjusting their compensation structures. Guaranty Trust Bank (GTBank) increased salaries by 40% in late 2024, Union Bank implemented a similar salary adjustment and Sterling Bank also introduced a 7% salary increase in January 2025, after previously launching a cost-of-living allowance (COLA) to cushion employees against inflation

As Nigeria continues to battle rising inflation, banks are expected to keep revising salaries to retain and attract talent. However, these wage increases also add pressure to operational costs and profit margins, making it crucial for financial institutions to find a sustainable balance between competitive salaries and long-term financial stability.

Wema Bank has yet to issue an official statement regarding the latest salary adjustments.